Unlocking the Power of Fixed Income

Episode 10

Bond Risk 101: Interest Rate Risk, Credit Risk, and Liquidity Risk

Introduction

Every bond investment carries some degree of risk. While bonds are often perceived as safer than stocks, they are not risk-free. Interest rate changes, credit quality shifts, and market liquidity all influence bond prices and returns. Understanding these risks is crucial for managing a fixed-income portfolio effectively.

In this episode, we’ll explore:

📌 Interest rate risk – How bond prices react to interest rate movements.

📌 Credit risk – The impact of issuer creditworthiness on bond valuation.

📌 Liquidity risk – Why some bonds are harder to buy or sell at fair value.

By the end, you’ll have a solid understanding of bond risks and strategies to mitigate them in your portfolio.

1. Interest Rate Risk – The Biggest Driver of Bond Price Movements

Interest rate risk refers to the inverse relationship between bond prices and interest rates—when rates rise, bond prices fall, and vice versa. This happens because new bonds issued at higher rates become more attractive, reducing the value of existing bonds with lower yields.

📌 How It Works:

✔ Higher interest rates → Bond prices decline (as investors prefer newly issued higher-yielding bonds).

✔ Lower interest rates → Bond prices rise (existing bonds with higher coupons become more valuable).

✔ Longer-term bonds are more sensitive to interest rate changes due to a concept known as duration risk.

📌 Example: The Impact of Rising Rates on a Bond

An investor holds a 10-year Australian Government Bond paying a 3% coupon rate. If the RBA raises interest rates and new government bonds are issued at 5%, the existing bond becomes less attractive. Investors now demand a higher yield, so the bond’s price drops until it offers a comparable yield to new bonds.

💡 Key Takeaway: Interest rate changes significantly impact bond prices. Longer-duration bonds experience larger price swings, making them riskier in volatile rate environments.

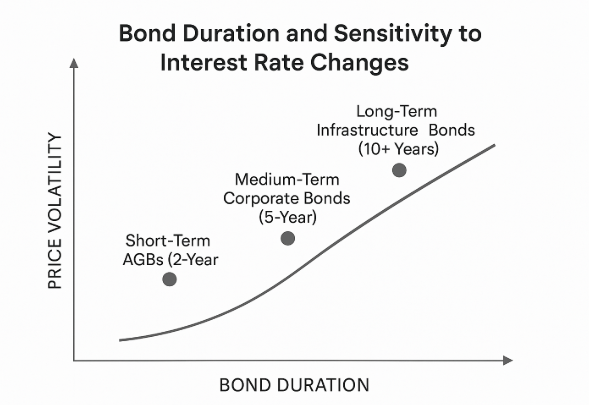

Figure 1: Bond Duration and Sensitivity to Interest Rate Changes

This figure shows how bond price volatility increases with duration. It plots three bond types—Short-Term AGBs (2-Year), Medium-Term Corporate Bonds (5-Year), and Long-Term Infrastructure Bonds (10+ Years)—along a rising curve, illustrating that longer-duration bonds are more sensitive to interest rate changes. The visual highlights the trade-off between yield and interest rate risk, helping investors understand how duration influences bond price movements.

2. Credit Risk – Assessing Default Risk in Bonds

Credit risk refers to the risk that the bond issuer fails to meet its debt obligations. While government bonds are considered low-risk, corporate and high-yield bonds have varying levels of default risk.

📌 Bond Ratings & Credit Quality

Credit rating agencies like Moody’s, S&P, and Fitch assess issuer creditworthiness, assigning ratings that impact bond pricing:

✔ Investment-Grade Bonds (AAA to BBB-) – Issued by financially stable entities, offering lower yields but lower risk.

✔ High-Yield Bonds (BB+ and below, aka "Junk Bonds") – Issued by companies with weaker credit profiles, offering higher yields but higher risk.

📌 Example: The Impact of a Credit Downgrade

A BBB-rated corporate bond is downgraded to BB+ (junk status) due to deteriorating financials. Institutional investors who are restricted from holding non-investment-grade debt sell the bond, causing its price to drop while its yield rises to compensate for the added risk.

💡 Key Takeaway: Investors should assess credit risk before buying bonds—higher yields come with greater potential for default. Diversifying bond holdings and monitoring credit ratings can help manage this risk.

3. Liquidity Risk – Why Some Bonds Are Harder to Trade

Liquidity risk refers to the difficulty of buying or selling a bond at fair market value. Unlike stocks, many bonds trade over-the-counter (OTC), meaning they are less frequently traded and may have wider bid-ask spreads.

📌 Factors Affecting Liquidity

✔ Government Bonds – Highly liquid, frequently traded, and easy to buy/sell.

✔ Corporate Bonds – Liquidity varies; blue-chip corporate bonds are more liquid than high-yield debt.

✔ Emerging Market Bonds – Less liquid, with price swings due to economic and political instability.

📌 Example: Liquidity Risk in Corporate Bonds

During market downturns, investors rush to sell riskier assets. High-yield bonds can suffer sharp price drops because buyers demand a discount due to uncertainty. In contrast, Australian Government Bonds (AGBs) remain liquid, as they are widely held and backed by the government.

💡 Key Takeaway: Bonds with lower liquidity may require investors to sell at a discount. Holding high-quality, liquid bonds ensures flexibility when market conditions tighten.

📌 Final Takeaways – Managing Bond Risks in Your Portfolio

✅ Interest rate risk – Longer-duration bonds are more sensitive to rate changes.

✅ Credit risk – Higher yields come with greater default risk; monitor bond ratings.

✅ Liquidity risk – Some bonds trade with wider spreads and lower liquidity.

🔹 Risk Management Strategies

✔ Diversify across issuers and maturities to reduce exposure to credit and interest rate risk.

✔ Use inflation-linked bonds (TIBs) to hedge against unexpected inflation.

✔ Hold a mix of government and corporate bonds for liquidity and income balance.

✔ Monitor the yield curve to adjust duration exposure based on rate expectations.

📌 Coming Up Next…

Next, we’ll explore "How to Buy Bonds in Australia: ASX, Over-the-Counter, and ETFs", covering:

✔ How Australian investors can access bonds.

✔ The pros and cons of buying bonds directly vs. bond ETFs.

✔ Where to find the best opportunities in the fixed-income market.

🔔 Stay tuned for more fixed-income insights! 🚀📈